Maximizing ROI: A Step-by-Step Guide to Higher Returns

Maximizing ROI: A Step-by-Step Guide to Higher Returns

In the world of business and investments, maximizing ROI (Return on Investment) is essential for achieving sustainable growth and profitability. Whether you’re managing a marketing campaign, investing in new technology, or running a business, understanding and implementing strategies to maximize ROI can significantly enhance your financial outcomes. This step-by-step guide will walk you through effective methods to boost your returns.

Maximizing ROI (Return on Investment) refers to strategies and actions taken to achieve the highest possible return from an investment relative to its cost. ROI is a key performance metric used to evaluate the efficiency or profitability of an investment, project, or business initiative. It helps measure how effectively resources (time, money, or effort) are being utilized to generate profit or achieve specific goals.

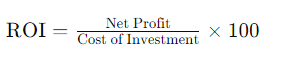

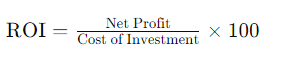

Understanding ROI

Return on Investment (ROI) is a performance measure used to evaluate the efficiency of an investment or compare the profitability of several investments. ROI is calculated using the formula:

A higher ROI indicates that the investment gains compare favorably to the cost. Maximizing ROI involves optimizing various factors to ensure that every dollar spent generates the highest possible return.

Step 1: Set Clear Objectives

Before embarking on any investment or project, it’s crucial to define clear, measurable objectives. Determine what success looks like and how you will measure it. Objectives might include increasing revenue, reducing costs, or enhancing customer satisfaction. Clear objectives provide a benchmark against which to measure ROI.

Step 2: Analyze and Select the Right Investments

Conduct thorough research and analysis to identify investment opportunities that align with your objectives. Consider the potential risks and returns of each option. Evaluate past performance, market conditions, and the credibility of the investment. Prioritize investments with a track record of high returns and low risk.

Step 3: Optimize Resource Allocation

Effective allocation of resources is key to maximizing ROI. Allocate budget and resources to initiatives with the highest return potential. Avoid spreading resources too thinly across multiple projects. Focus on high-impact areas where your investment is likely to yield the best results.

Also read: 10 Strategies to Improve Your ROI in Digital Marketing

Step 4: Monitor and Adjust Strategies

Regularly track the performance of your investments and initiatives. Use key performance indicators (KPIs) and analytics tools to measure progress against your objectives. If certain strategies are underperforming, be prepared to adjust or pivot your approach. Continuous monitoring and adaptation are vital for sustaining high ROI.

Step 5: Implement Cost Control Measures

Controlling costs is essential for maximizing ROI. Identify areas where you can reduce expenses without compromising quality or performance. Implement cost-saving measures such as renegotiating contracts, streamlining operations, or leveraging technology to improve efficiency.

Step 6: Leverage Technology and Automation

Investing in technology and automation can significantly enhance your ROI. Tools and software can streamline processes, reduce manual labor, and provide valuable insights through data analysis. Embrace innovations that can improve productivity and profitability.

Step 7: Evaluate and Learn from Outcomes

After completing an investment or project, evaluate the outcomes against your objectives. Analyze what worked well and what didn’t. Use these insights to refine your strategies and improve future investments. Learning from past experiences is crucial for maximizing ROI over time.

Step 8: Adjust Strategies as Needed

Be prepared to adjust your strategies based on performance data and changing circumstances. If certain approaches are not delivering the expected results, refine your tactics or pivot to alternative solutions. Flexibility and adaptability are crucial for maximizing ROI.

Benefits: Maximizing ROI: A Step-by-Step Guide to Higher Returns

Higher Financial Returns: Implementing effective strategies ensures greater profitability from investments, leading to increased financial gains.

Enhanced Efficiency: Streamlined processes and optimal resource allocation improve operational efficiency, reducing waste and maximizing output.

Improved Investment Decisions: A structured approach helps in making informed investment choices, aligning with strategic goals and risk tolerance.

Effective Cost Management: Identifying and controlling costs helps in reducing unnecessary expenses, thus enhancing overall profitability.

Stronger Financial Health: Maximizing ROI contributes to better financial performance, providing a solid foundation for future growth and stability.

Strategic Growth Opportunities: Higher returns create the financial capacity for business expansion and pursuing new growth opportunities.

Competitive Advantage: Efficient management of investments can improve market position and provide a competitive edge in your industry.

Risk Mitigation: A comprehensive ROI strategy helps in identifying potential risks and implementing measures to mitigate them effectively.

FAQs

What is ROI and why is it important?

ROI stands for Return on Investment. It measures the profitability of an investment relative to its cost. Maximizing ROI is important because it helps ensure that resources are used efficiently and effectively, leading to higher financial returns.

How can I calculate ROI?

ROI is calculated using the formula:

Net Profit is the revenue generated from the investment minus the cost of the investment.

What are some strategies for maximizing ROI?

Strategies for maximizing ROI include setting clear objectives, analyzing and selecting the right investments, optimizing resource allocation, monitoring and adjusting strategies, implementing cost control measures, leveraging technology and automation, and evaluating outcomes.

How often should I review my ROI?

It’s important to regularly review ROI to ensure investments are performing as expected. Depending on the nature of the investment or project, this could be monthly, quarterly, or annually.

Can technology help in maximizing ROI?

Yes, technology can significantly aid in maximizing ROI by improving efficiency, reducing costs, and providing data-driven insights. Tools for analytics, automation, and process management can enhance overall performance and profitability.

Conclusion

Maximizing ROI involves a strategic approach to investments and resource management. By setting clear objectives, selecting the right investments, optimizing resource allocation, and leveraging technology, you can significantly enhance your financial returns. Regular monitoring and adaptation, coupled with cost control and learning from outcomes, will help ensure that your investments yield the highest possible returns.